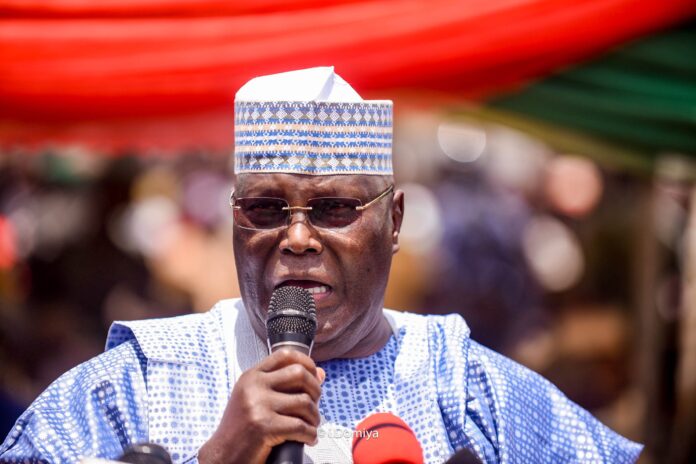

The presidential candidate of the People’s Democratic Party, Atiku Abubakar, has added his voice to the call for the Central Bank of Nigeria, CBN, to extend its January 31 deadline for the swap of old naira notes for the new currencies.

While acknowledging that the monetary conversion policy is a global practice, Mr Abubakar said he was constrained to align his position with many Nigerians who have called for the extension due to the difficulties people go through in swapping the currencies, especially those in the rural areas.

The former vice president, who made the call in a video message posted on his verified social media handles on Saturday, said the pain caused by this policy was not intended for the initiative and urged the government and regulatory agencies to extend the deadline.

“The ongoing policy of the Central Bank of Nigeria to redesign the naira has generated wild reaction across the country, and beyond.

“This exercise is a world wide practice, and there is nothing new with it especially as the January 31st deadline draws closer. A great number of Nigerians, out of good conscience, have expressed apprehension about how the policy and deadline will make life more difficult for them.

“The large numbers of our unbanked population, whose businesses, especially in rural areas, will find it almost impossible to meet up with the deadline of January 31st to change their old bank notes to the redesigned currencies.

“I’m aware of the challenges, the farmers and other artisans in remote areas in our country go through in moving cash to commercial banks.

“On this note I’m compelled to align my position with the upsurge of demand for a slight extension of the monetary conversation policy, Mr Abubakar said.

Speaking further, the PDP candidate said, “the January 31st deadline will certainly cause heavy discomfort on our people.

“And it will be magnanimous on the part of government and the regulatory agency to ease the burden on the people in the public interest, while we can continue to sensitise the public on the imperative of the mobile banking policy.

“It is important for the CBN to consider an extension for the public to swap their old notes, thereby reducing the financial consequences on these vulnerable citizens. I believe that such a painful experience is not the intention behind the initiative.”