The Bola Tinubu-led Nigerian government has revealed plans to introduce cutting-edge national identity cards integrated with payment and social service features, marking a significant leap in citizen services.

In a statement from Kayode Adegoke, Head of Corporate Communications at the National Identity Management Commission (NIMC), the collaboration between the Federal Government, NIMC, Central Bank of Nigeria (CBN), and Nigeria Inter-bank Settlement System (NIBSS) has birthed what he termed an “innovative identity solution” through the national domestic card scheme, AfriGO.

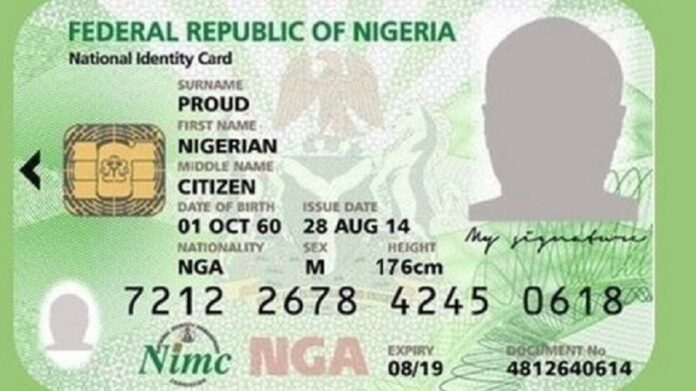

Adegoke emphasized that these new National ID cards, built with robust identity verification features, align with the NIMC Act No. 23 of 2007, which mandates issuance of General Multipurpose cards (GMPC) to Nigerians and legal residents.

“This card will fulfill the need for physical identification, granting access to government and private services, fostering financial inclusion, empowering citizens, and encouraging active participation in nation-building,” Adegoke stated.

Only individuals with a National Identification Number (NIN) will qualify for this multi-functional card, adhering to ICAO standards and designed as Nigeria’s primary national ID.

Additionally, the card will serve as a debit or prepaid card when linked to chosen bank accounts, providing a gateway to various government aid programs for those previously excluded from financial and social services.

Adegoke assured that data protection measures are paramount, adhering to international security standards to safeguard users’ personal information.

Key features of the new national identity card include a Machine-readable Zone (MRZ) compliant with ICAO standards, integrated travel and health insurance details, agricultural and energy subsidies, and Nigeria’s Quick Response Code (NQR) featuring the national ID number.

The card boasts biometric authentication through fingerprint and pictures, ensuring secure identity verification even in areas with limited network coverage. Its offline functionality facilitates transactions in connectivity-challenged regions.

Citizens and legal residents can apply for these cards online, at commercial banks, various participating agencies, or NIMC offices nationwide, ensuring widespread accessibility to this groundbreaking identity and payment solution.